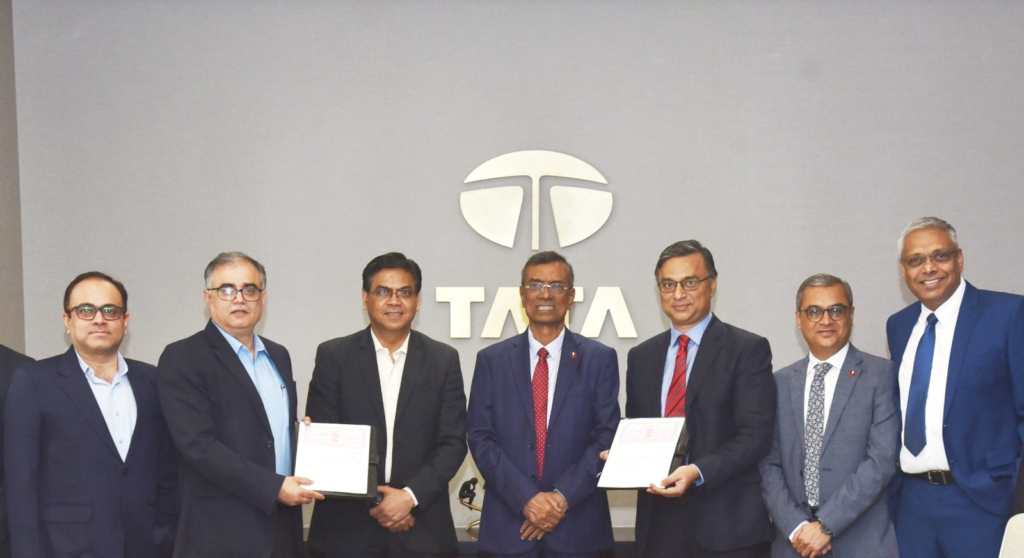

Kolkata, February 12, 2024: Bandhan Bank, a leading private sector bank in India known for its rapid growth, has announced a strategic partnership with Tata Motors, a prominent player in the automotive industry, to provide convenient financing solutions for commercial vehicle customers. This collaboration, marked by the signing of a Memorandum of Understanding (MoU), aims to simplify the financing process and offer attractive options to customers across Tata Motors’ commercial vehicle portfolio.

Mr. Santosh Nair, Head of Consumer Lending & Mortgages at Bandhan Bank, expressed enthusiasm about the partnership, stating, “Bandhan Bank is delighted to collaborate with Tata Motors to offer seamless vehicle financing solutions. This partnership underscores our commitment to meeting the diverse financial needs of commercial vehicle customers. We believe that by leveraging our extensive network and crafting tailored financing options, we can support the growth aspirations of businesses in the commercial vehicle segment.”

Echoing this sentiment, Mr. Rajesh Kaul, Vice President & Business Head – Trucks, Tata Motors, emphasized the significance of the collaboration, saying, “We are pleased to announce our partnership with Bandhan Bank through this MoU, marking a significant milestone in our journey to provide seamless financing solutions to our customers. This partnership reflects our commitment to offering accessible and efficient financial solutions, empowering our customers to achieve their business objectives effortlessly. Together, we aim to enhance convenience and support for our valued commercial vehicle customers.”

Tata Motors boasts an extensive range of commercial vehicles, catering to various segments ranging from sub 1-tonne to 55-tonne cargo vehicles, as well as 10-seater to 51-seater mass mobility solutions. The company’s offerings include small commercial vehicles, pickups, trucks, and buses, all designed to meet the evolving needs of logistics and mass mobility segments. Tata Motors prioritizes quality and service commitment, ensuring customer satisfaction through its vast network of over 2500 touchpoints manned by trained specialists and offering easy access to Tata Genuine Parts.

Meanwhile, Bandhan Bank has been steadily expanding its portfolio in sectors such as SME loans, gold loans, personal loans, and auto loans, among others. The bank has recently ventured into new verticals like commercial vehicle lending and loans against property for businesses. This strategic collaboration with Tata Motors aligns with Bandhan Bank’s growth strategy and its commitment to providing innovative financial solutions to its customers.

The partnership between Bandhan Bank and Tata Motors represents a significant step forward in enhancing the accessibility and affordability of commercial vehicle financing solutions. By combining Tata Motors’ expertise in the automotive industry with Bandhan Bank’s robust financial services, the collaboration aims to empower businesses and drive economic growth in the commercial vehicle segment. As the two entities join forces, they are poised to deliver greater value and convenience to customers, reinforcing their positions as trusted partners in the journey towards business success.